Sign up for Funding Circle newsletter!

Get our latest news and information on business finance, management and growth.

Updated: March 27th, 2020

Is your client creditworthy? It seems like a simple question that would have a simple yes-or-no answer — but not everyone determines “creditworthiness” the same way. That’s why your client might be rejected by some lenders, accepted by others, and then offered a range of different interest rates.

Most lenders follow the 5 Cs of Credit guidelines to help them make credit decisions, but our underwriting process is different from traditional banks and other online lenders because we read into the real story behind each business and strive to see the bigger picture. At Funding Circle, we respect the fundamentals, but we know that if we simply compared your client’s business to a standard checklist, we could miss the unique characteristics that make their business successful.

And while we can’t guarantee that all of your clients will qualify for a Funding Circle loan, we do promise to help you understand our credit criteria so that you can spend your energy focusing on deals that are likely to get approved — saving you and your client both time and money.

At Funding Circle, when we underwrite a loan for our marketplace it’s kind of like recommending a good book to a friend. The investors on our marketplace have learned to trust our recommendations because we help them determine which books they might enjoy reading and which ones should be left on the shelf.

To do this accurately and efficiently, we combine innovative Silicon Valley technology with traditional Wall Street business acumen to create a unique “book review” system. Every loan on our marketplace is run through our proprietary credit algorithm before being examined by an expert small business underwriter.

Like a member of the Pulitzer Prize committee, the underwriter dives deeply into each application. They begin by looking through the documents you upload into the portal. While traditional banks require borrowers to provide volumes of financial statements to prove their creditworthiness, we only ask you to submit about five sets of documents.

These documents are kind of like the “Sparknotes” version of your client’s business. They provide the setting, a list of characters and the basic plot points — enough to tell us if we should read the book, but not enough to get an A+ on an elementary school book report.

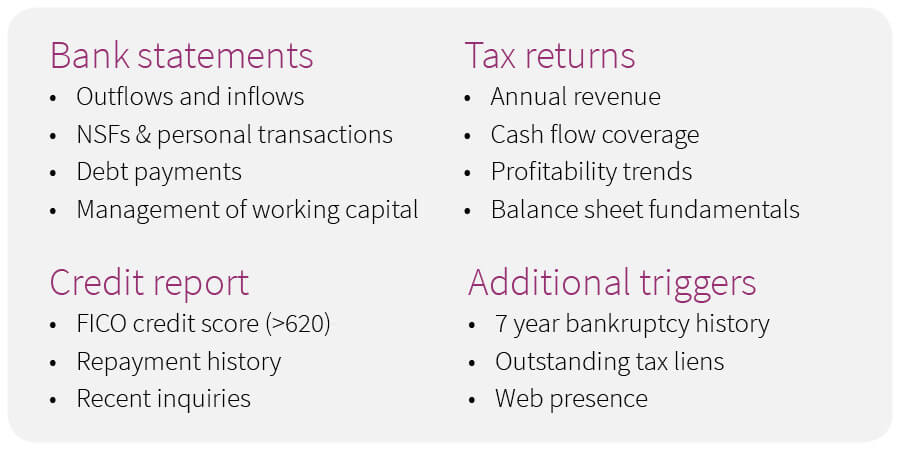

Our underwriters use these initial data points to start constructing the full narrative of your client’s business. The elements they consider include, but are not limited to:

>> Download Funding Circle’s Extended Credit Criteria Cheat Sheet <<

Just as you shouldn’t judge a book by its cover, we don’t believe in judging a small business’s creditworthiness by any single metric. If we did, we might miss out on an opportunity to read a really great book!

While some data points have specific restrictions, everything is always taken in context. For example, we understand that the standards for a “good book” vary across different genres. Just as a crime-thriller novel doesn’t need the same character development as a memoir, a software company doesn’t necessarily need the same kind of asset coverage as a retail location. It’s also difficult to define a “good book” in an entirely objective manner. Different readers have different preferences, and some investors are willing to accept higher risk options in exchange for larger potential yields.

But while we never recommend anyone buys a book based solely on the cover art, we do use the business owner’s personal credit score to tell us if it’s worth taking the book off the shelf and reading the synopsis on the back. For that reason, we have a minimum FICO score requirement and at least 2 years of operating history to be eligible for a Funding Circle loan.

Because there are so many variables at play, an underwriter will often ask to speak directly with your client to learn more about their business. During a scheduled credit call, the underwriter may ask questions about why your client started their business, the opportunities and challenges they’re currently facing, and how the loan will help their business grow. The underwriter is looking for answers to specific questions, but most importantly this is an opportunity for your client to show how passionate and excited they are for the future of their business.

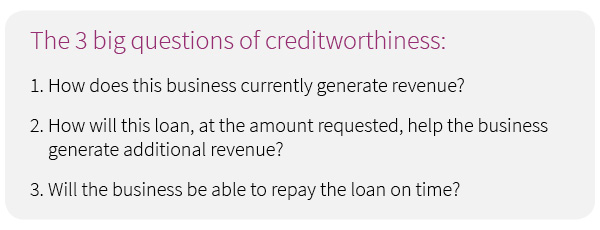

Your job as a Referral Partner is to make sure your client’s story comes through during the entire process. It’s okay if the business has had some ups and downs — every good book has at least one plot twist — but the general trends should be positive. Ultimately, our underwriters are trying to answer to three big questions:

Once all the information has been collected, synthesized and analyzed, it’s up to the underwriter to approve the loan and confirm the interest rate suggested by our credit model. If your client accepts the offer, the “book report” is posted to our marketplace along with its final grade.

With so many plot points to consider, it might seem difficult to pick the next New York Times Best Seller, but the good news is that you don’t have to do it alone.

Your Relationship Manager can help pre-screen your deals before each submission. Registered Referral Partners are also invited to attend our weekly teach-in webinars, where you’ll learn how to build a library of clients that meet our basic criteria.

Louis DeNicola is the president of LD Money Media LLC and an experienced finance writer who specializes in credit, personal finance, and small business finance. Within the small business sphere, he helps business owners understand their financing options, cash flow management, business credit, and taxes. In addition to Funding Circle, you can find his work on BlueVine, Credit Karma, Experian, Wirecutter, and Lending Tree.