Sign up for Funding Circle newsletter!

Get our latest news and information on business finance, management and growth.

Updated: December 18th, 2023

In our guide to financial forecasting, we mention the importance of keeping track of key financial ratios since investors and lenders use those ratios to evaluate your small business. Financial ratios have different purposes: some indicate the profitability of a business and others measure the ability of a business to use its operating cash flow to meet its debts. To help you determine the most suitable financial ratios for your small business, let’s review these common formulas that are most relevant to lenders and investors.

These set of ratios allow a lender to determine how a small business owner can use her most liquid assets (those that can be turned into cash the fastest) to meet her most immediate financial obligations.

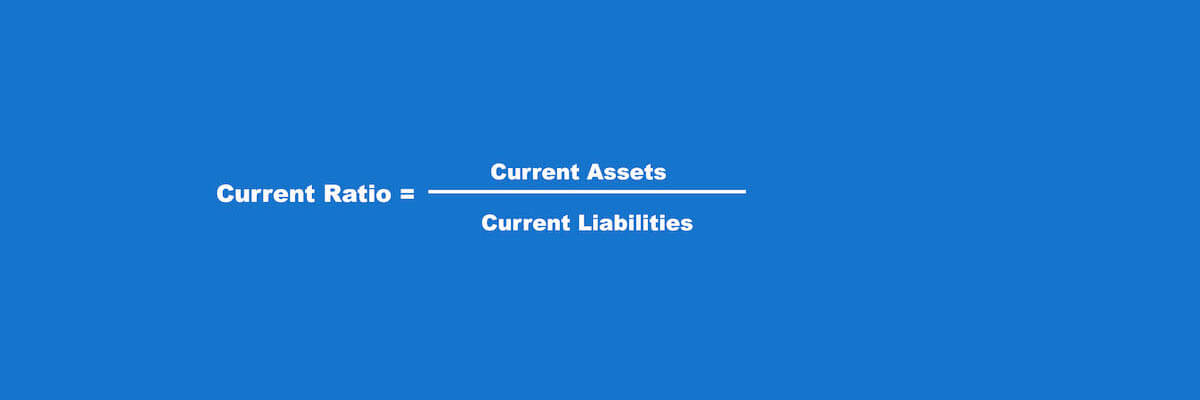

The current ratio measures the working capital position of a small business, which is the ability to use short-term assets, such as cash and inventory, to cover financial obligations due within a year. Lending officers of working capital loans use the current ratio in context of the operating and financing activities to have a full picture of the liquidity of a company.

That’s why you need to do your own cash flow analysis on a monthly basis to be ready to answer any questions.

Also known as the acid-test ratio, the quick ratio is a much more astringent liquidity ratio than the current ratio and measures the ability of a business to use its most liquid assets to cover its current liabilities. While a lender won’t expect you to have a high quick ratio, he’ll see a very low quick ratio as a red flag that a cash crunch could increase your chances of turning in your monthly payments late – or even worse at all.

This ratio is particularly important for applications to very short-term loans or loans collateralized with financial vehicles or accounts receivable.

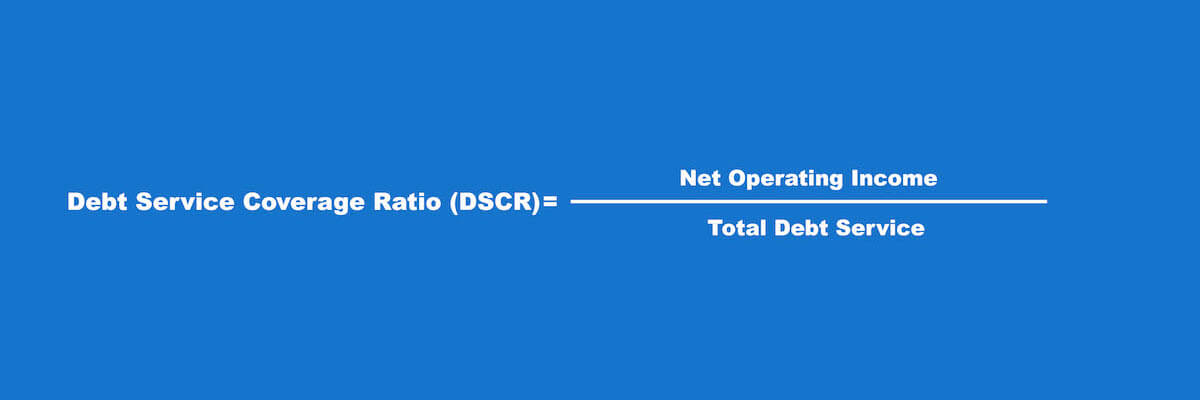

This financial ratio is commonly used in a term loan application.

When calculating net operating income, you generally only deduct annual operating expenses (without tax or interest payments) from total annual revenue. The total debt service includes all payments for short-term and long-term debts due within the year.

DSCR requirements vary per lender. At Funding Circle, we require a minimum DSCR of 1.15 to approve a term loan. For loans with a term longer than one year, Funding Circle takes the average DSCR of all years. Download this free template for calculating the DSCR of your small business.

Investors use profitability ratios to determine the sustainability of a small business operations and estimate the potential benefit for incoming investors.

While there are different types of profit margin ratios, the operating profit margin provides a closer look at the effects of managers in a business. You determine the operating profit by subtracting selling, general, and administrative expenses – those not directly related to the manufacturing of a product – from profit.

Since managers have more control over direct operating expenses than selling, general, and administrative expenses, investors look for trends in this ratio to determine whether or not to stick with the current management team in case of making an investment.

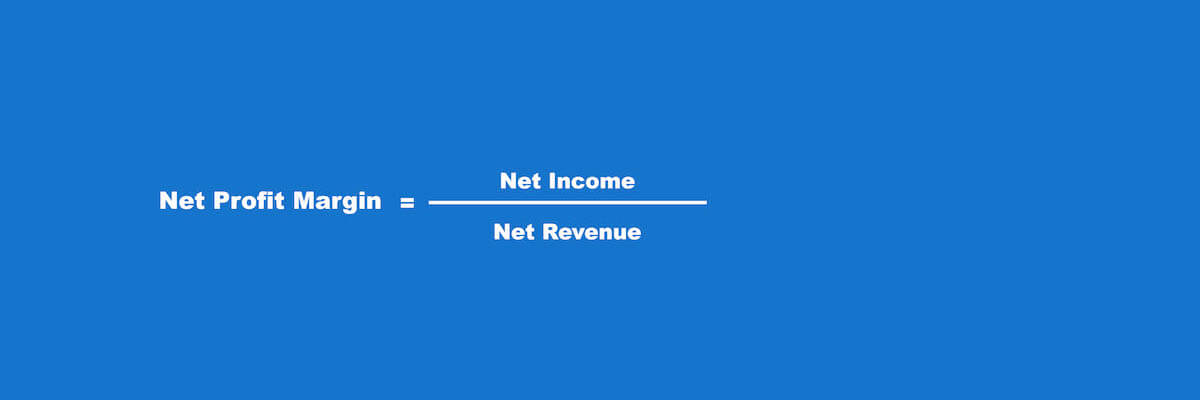

When financial analysts refer to the bottom line, they’re referring to the net profit margin. This ratio owes its name to the fact that you find the net income at the bottom of your income statement. While investors may be impressed with sales growth of 60% year-over-year over the last years, they won’t be as impressed if expenses are growing at an even faster rate. The net profit margin can uncover such a trend.

While this financial ratio is a very important one, it needs to be put into perspective over a period of time. That’s why it’s key that you keep track of your net profit margin over time and can present forecasts for that ratio for the next three to five years.

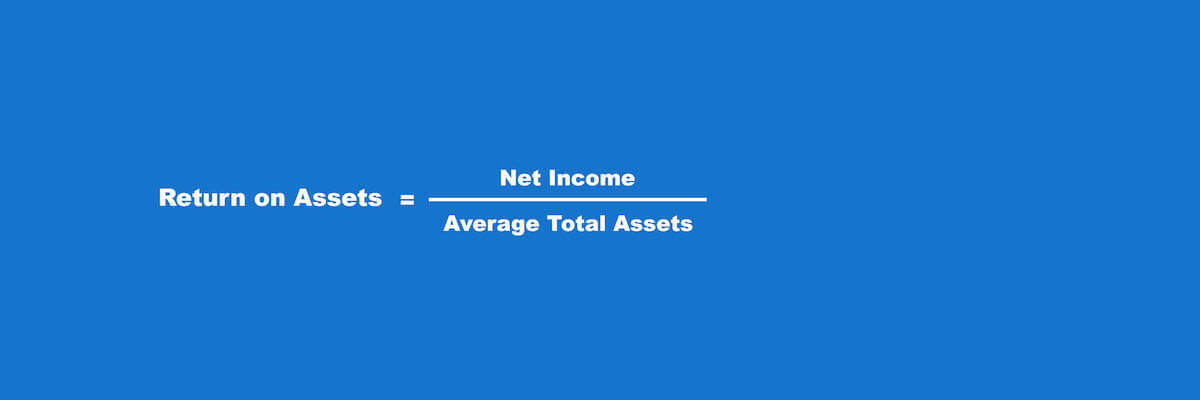

Whether your small business is being considered for a term loan or influx of venture capital, you’re probably thinking about making use of those incoming funds to invest in additional assets to increase profits. To calculate average total assets, add the balance of total assets at the beginning and at the end of the year and then divide that sum by two.

The ROA tells lenders and investors about your track record on using past and current assets to generate net income. While ROAs vary per industry, most investors like to see a ROA of a least 5%.

A healthy cash flow is key to maintain a sustainable operation. The following financial ratios look at how much cash is generated through sales, how much cash is “free” (available for investments or reserves), and how much cash goes to debtors.

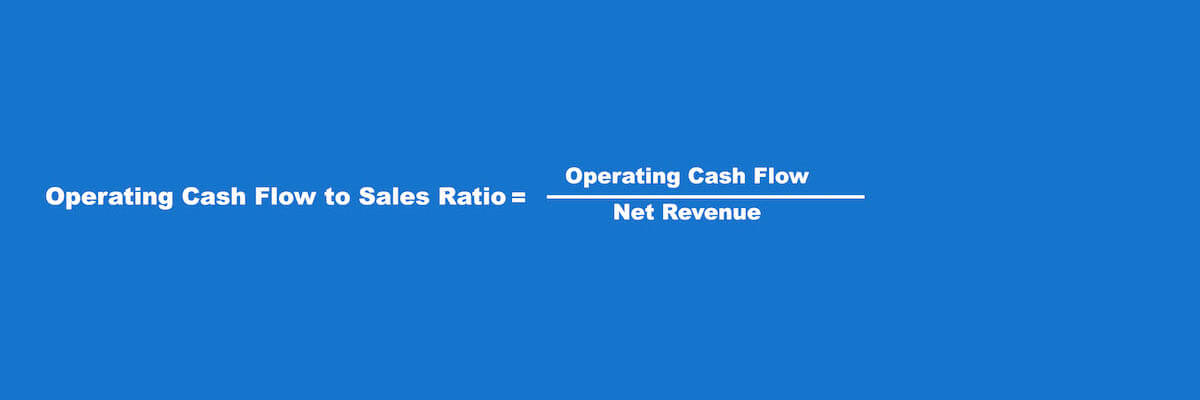

This ratio indicates how a small business owner makes uses of it cash to generate sales. As discussed during the cash flow analysis, cash flows from operating activities are cash inflows and outflows directly related to your core business operations. To reconcile net income with net cash flow from operating activities, you’ll need to add and subtract certain items, such as in depreciation, changes in prepaid expenses, and changes in taxes payable. For a list of these cash flows, refer to the table here.

Ideally, lenders and investors would like to see an increasing operating cash flow to sales ratio. Still, a ratio within a small and predictable range over a long period of time is an equal sign of healthy cash flow for small businesses with many years of operation.

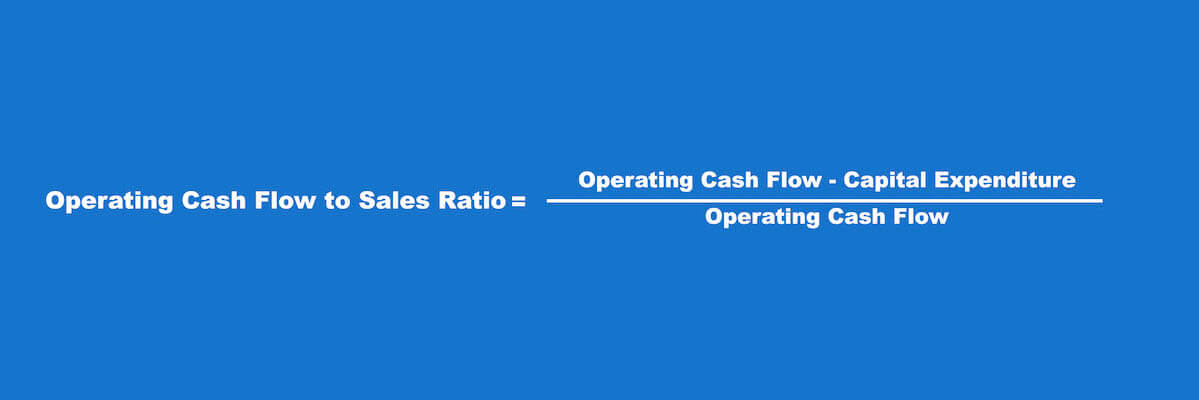

By taking out the capital expenditures, such as real estate acquisitions or heavy equipment purchases, from your operating cash flow, you determine the cash from your operation that is “free” for use.

Investors like to see a large percentage of free cash flow available because that means that the company has the means to make additional capital improvements or provide a dividend payment. Lenders like to see a high free cash flow to operating cash flow ratio too because that indicates that the small business is better prepared for handling cash crunches and continuing to meet monthly debt payments.

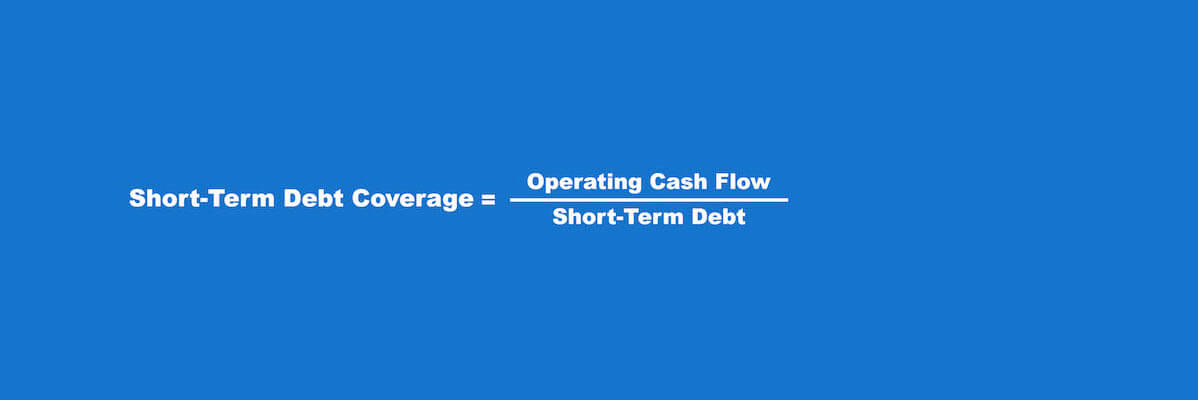

An alternative to the quick ratio, the short-term debt coverage evaluates the ability of a small business to cover its most immediate liabilities with the cash generated from core operations. The larger this ratio, the happier your lenders.

When a small business is able to score well in these three cash flow ratios, it becomes very attractive for investors and lenders.

The following two ratios are often classified under activity ratios, but we feel that, when talking about small businesses, these ratios deserve their own category. Financial institutions generally appraise eligible receivables at 70% to 80% of their value for asset-backed loans, so it’s a good idea to keep tabs on your ability to collect cash from credit customers, if applicable.

Depending on the industry of your small business, this ratio may be calculated on an annual or quarterly basis. The average accounts receivable is calculated as the sum of the initial and ending balance of accounts receivables for the applicable period and that sum divided by two.

When planning to use your receivables under 90 days to collateralize a loan, seek to optimize this financial ratio over a period of three years. A low accounts receivable turnover is a signal of the need to improve credit screening of clients and collection practices. However, an improving trend of receivables turnover could signal that your policies are working and would provide peace of mind to inquiring lenders.

Still, a very high accounts receivable turnover isn’t necessarily a good thing. When the one from your small business is way above the industry standard, it could be a sign that you’re losing potential sales due to a too tight credit policy.

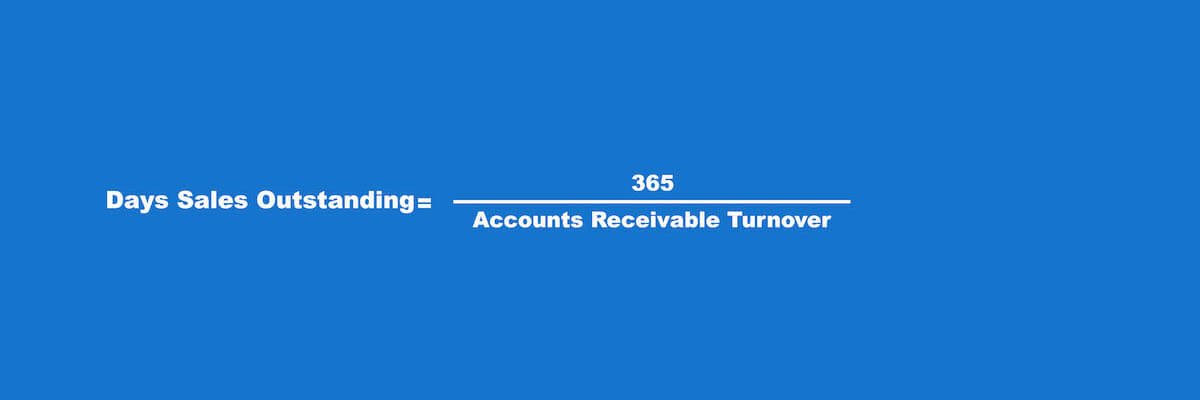

Your day sales outstanding tells you how many days your clients on credit are taking to pay you back. If you’re extending credit for 45 days and you’re able to collect payment in 35, keep up the good work. Under the same credit policy, 53 days sales outstanding would be a sign of trouble.

Pay particular attention to days sales outstanding when trying to use your 60- to 90-day accounts receivable. You want to make sure that this ratio backs up your claim that those accounts can actually be collected within 60 or 90 days.

While there are many more financial ratios, these ones should provide you with a solid starting point to start evaluating your small business. Management guru Peter Drucker said it best, “You can’t manage what you don’t measure”. By taking a closer look at the trends in liquidity, profitability, cash flow and collection of your small business, you’ll be better prepared to make more informed business decisions. And be able to present a complete picture of your business to potential lenders and investors.

Also, financial ratios can be very useful in quantifying performance benchmarks to strive towards. If you have an accountant or bookkeeper, consult him about what other financial ratios would be useful for your unique situation.

Samantha Novick is a senior editor at Funding Circle, specializing in small business financing. She has a bachelor's degree from the Gallatin School of Individualized Study at New York University. Prior to Funding Circle, Samantha was a community manager at Marcus by Goldman Sachs. Her work has been featured in a number of top small business resource sites and publications.