Sign up for Funding Circle newsletter!

Get our latest news and information on business finance, management and growth.

Updated: August 3rd, 2023

At Funding Circle we’re creating the infrastructure where any investor, big or small, can lend to small businesses.

This means building a sustainable platform that allows investors to earn attractive and stable returns by lending to creditworthy businesses, during every stage of an economic cycle. Since 2010, globally we’ve improved access to affordable capital for more than 62,000 businesses, and opened up a new asset class for over 88,000 investors.

Recently we conducted a stress testing exercise as part of our ongoing risk management. This is just one of many steps we’ve taken as part of a comprehensive, data-driven approach to risk management at Funding Circle.

Stress tests allow organizations to estimate how assets, such as small business loans, are likely to perform during adverse economic periods. These tests form an integral part of any prudent risk management strategy.

Our exercise simulated the impact that conditions associated with an economic recession, like rising unemployment rates and falling home prices, could have on investor returns on our platform. A recession is characterized by a sustained period ‒ typically two consecutive quarters ‒ of negative GDP growth.

Let’s take a closer look:

The starting point for our stress test was to create a macro-economic model. To do this, we analyzed the historic relationship between U.S. business defaults and key economic indicators including inflation, unemployment and interest rates. Carefully combining the right mix and weighting of indicators allows us to estimate how small businesses’ credit performance react to changing macro-economic conditions.

The composition of Funding Circle’s borrowers generally reflects the overall small business landscape in the U.S. today, and our loanbook is well-diversified across regions and sectors. This means we were able to use historic U.S. small business credit data as a good proxy for the ways that our small business borrowers would react in stress conditions.

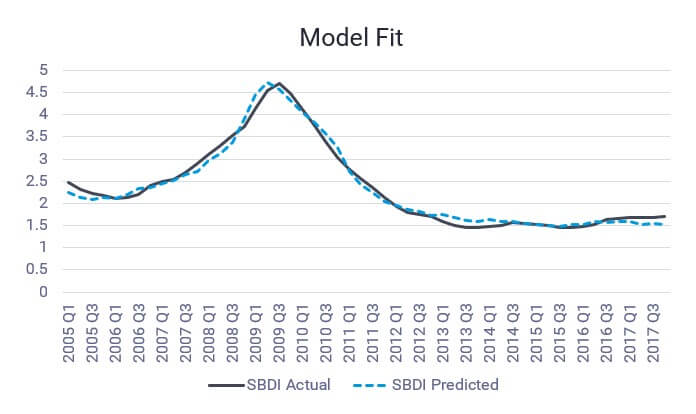

The chart below shows how closely the historic U.S. small business delinquency and default index correlates with the index estimated by our macro-economic model. This includes the years of the last global economic recession.

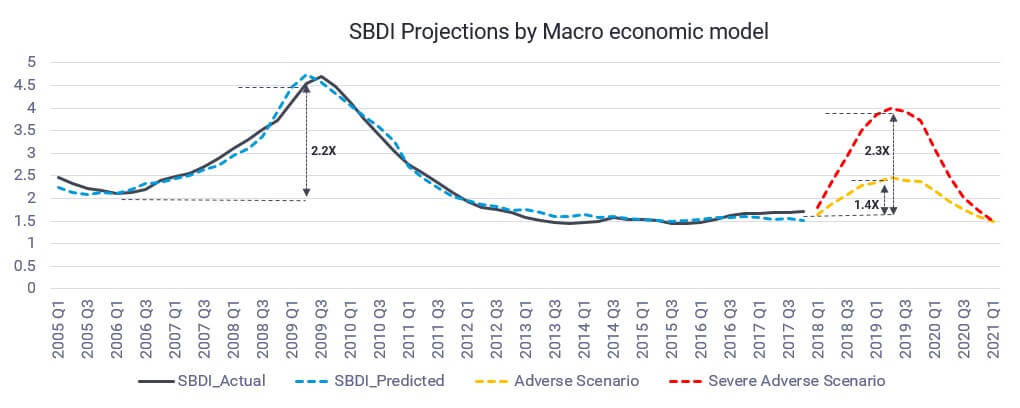

Using our macro-economic model, we simulated the level of stress that could be expected in the future under two scenarios provided by the Federal Reserve Board this year (for use in U.S. bank stress testing).

Fed stress parameters included:

| Adverse Scenario | Severely Adverse Scenario | |

| GDP | Falls 2 ¼ percent below Q4 2017 | Falls 7 ½ percent below Q4 2017 |

| Unemployment | Rises to 7% | Rises to 10% |

| Home Prices | Falls 12% | Falls 30-40% |

Expected level of stress from these scenarios:

Next, we established a baseline for how we expected our loans to perform if the U.S. economy remained stable. For this baseline we are using our latest Q3 2018 cohort of originations, with expected investor returns between 6 and 8 percent annualized.

Finally, we applied the expected levels of stress from the Fed scenarios onto our baseline and simulated the corresponding changes in investor returns.

This simulation shows that even in the severely adverse scenario — which included the U.S. unemployment rate rising to its October 2009 peak — investor returns would remain positive.

More specifically:

This can be compared to the 6 to 8 percent returns in the baseline scenario.

It is important to note that this simulation is conservative since does not account for the actions Funding Circle would actually take to protect returns in the case of a recession — like credit parameters tightening or pricing adjustments.

In reality we do have a number of processes in place to anticipate and rapidly respond to worsening economic conditions. In addition to closely monitoring the performance of loans, we also track external macroeconomic conditions to help us identify when a downturn may be approaching. If there were signs that conditions were worsening, we would have the ability to make credit strategy changes for newer loans to protect investor yield.

Funding Circle works by allowing investors to earn stable returns by lending to small businesses. Transparency is at the core of our business model. It is important that our investors understand the risk profile of their investment to make well-informed decisions.

The results of the test are good news, and not just for investors. Lending through Funding Circle has been shown to provide a macroeconomic boost through job creation and $2 billion in value added to the U.S. economy. It will, therefore, be all the more important for our economic recovery that small businesses can still access capital during a downturn.

We hope you’ve found this information useful. You can read more about the performance of Funding Circle loans on our statistics page.

| It’s important to remember: The nature of modelling for future economic events is that it is always an estimate. Past performance is not necessarily a guide to future returns. Capital is at risk when lending to businesses. Our stress testing looked at specific stressed scenarios. Actual recessions are likely to vary in their severity. The range of returns shown represents average returns for the overall loanbook. Returns earned on an individual portfolio may be higher or lower. |