Sign up for Funding Circle newsletter!

Get our latest news and information on business finance, management and growth.

Updated: March 27th, 2020

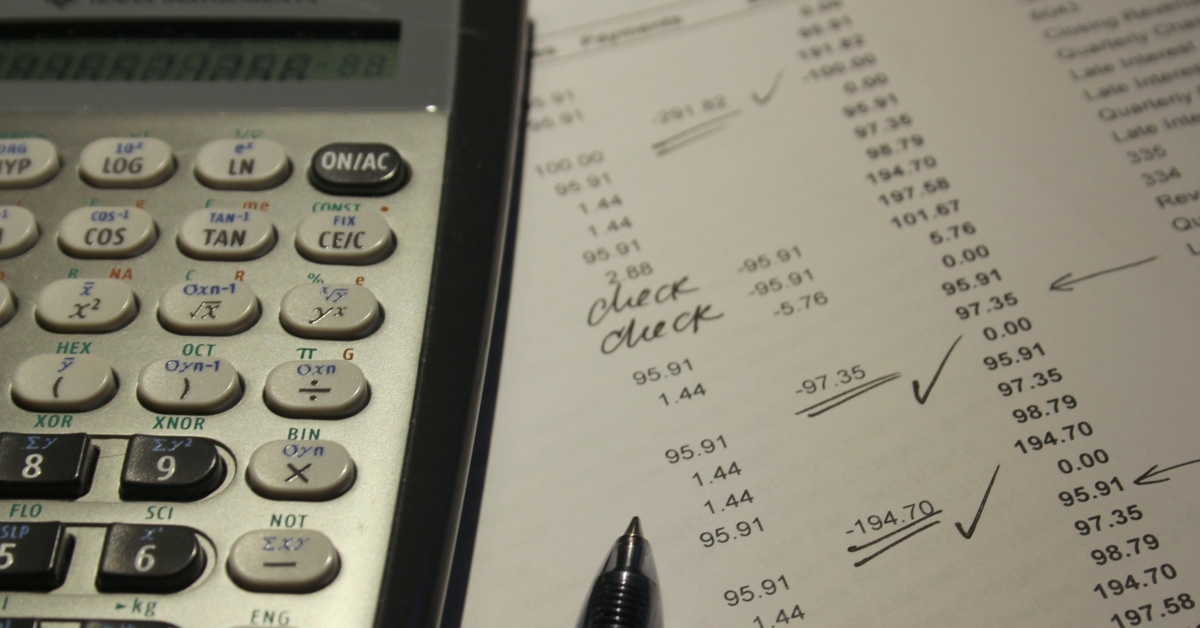

Closing out your books at the end of the year serves many important purposes for your business, including ensuring that you’re using the most accurate data for decision-making like budgeting and tax preparation. This is why it’s important to take the time to review and check for accuracy.

While your income statement (or profit and loss statement) gives you a summary of what the business accomplished during the year, your balance sheet is how accountants verify that the information on the income statement is accurate. Your balance sheet is a snapshot of the company on a particular day, while your income statement shows activity that happened over a period of time.

Ready to close out your books? Here are seven steps to take:

For cash basis businesses, which are businesses that only count income when a payment is received, the bank accounts tell a lot of the story. The receipt or disbursement of cash is what triggers the taxable event.

When reconciling an account, start with the beginning balance and confirm that each transaction that went through the bank account has been posted to your accounting system. Any items posted to your accounting system that have not cleared the bank are considered outstanding items. Review these items to find out why they haven’t cleared; it’s possible the recipient hasn’t cashed the check yet and the item will clear the following month.

Common reasons outstanding items are created in your accounting system include duplicate entries and lost or uncashed checks. Outstanding items should be addressed and corrected by either deleting duplicate entries or reissuing checks. Once all items have been confirmed or reviewed, the ending balance should reconcile to what the bank has on file.

Once you’ve provided a service or sold a product in advance of payment, you should create an invoice. If you haven’t received payment for this invoice, it’ll generate a balance in the accounts receivable account. Review amounts that are older than 30 days to find out if a payment was misapplied or if the client forgot to send in a payment.

Accounts payable tracks amounts you owe to vendors. If you record the expense at the time the invoice is received and pay later based on the terms of the invoice, these unpaid amounts will make up the balance in accounts payable.

If your business is product-based and has inventory, you should do a physical inventory count as close to year end as possible. This count will provide information and support for inventory that remains on the balance sheet on December 31.

Review your fixed asset accounts and make sure new equipment, furniture, fixtures, vehicles, buildings, and building improvements have been added to the depreciation schedule. Also, ensure the related depreciation expenses have been updated for the current year. This is often done by your accountant and is an adjusting journal entry (AJE) that you will need to record in your books.

The sales tax you’ve collected from your customers and withholdings you’ve taken out of employees’ paychecks appear as liabilities on your balance sheet. These amounts need to be sent to federal or state agencies and may be paid right away, monthly, quarterly, or even annually. Reviewing these accounts is important to ensure that you are collecting or withholding the correct amounts to begin with and that you are sending all the funds to the state based on the required schedule. Federal and State trust fund penalties can add up quickly if you fail to follow the rules related to these types of taxes.

Confirm that the funds recorded to the owner equity accounts are for funds you put into the business as capital or distributions you took out as a return on investment.

The goal for this step is to make sure income and expenses are classified into their correct accounts. Any expenses that have deduction limitations, such as meals or entertainment, should be properly recorded to accounts that easily identify them as such expenses.

Once you have reviewed the balance sheet accounts, it’s time to review the income statement. The income statement will summarize the income earned and expenses incurred during the year, showing you the net income of the business.

If you’ve reconciled or confirmed the balances of accounts on the balance sheet as of January 1 and again as of December 31, your activity on the income statement should be accurate. You can take steps to tie out or review the amounts in various accounts on the income statement to make sure they are classified correctly, but in general, the net should be correct.

Following these steps will help ensure your books are accurate for the year and provide data that can be used when setting goals for the coming year. Additionally, the end of the year is a great time to do a final review of vendor and employee files — check to make sure you have all the necessary documents in those files. And once your books are closed, reach out to your CPA. It can be a great time to discuss tax implications and any necessary filings for the year.

Paige Smith is a content marketing writer who specializes in writing about the intersection of business, finance, and tech. Paige regularly writes for a number of B2B industry leaders, including fintech companies, small business lenders, and business credit resource sites.