Sign up for Funding Circle newsletter!

Get our latest news and information on business finance, management and growth.

Updated: June 5th, 2023

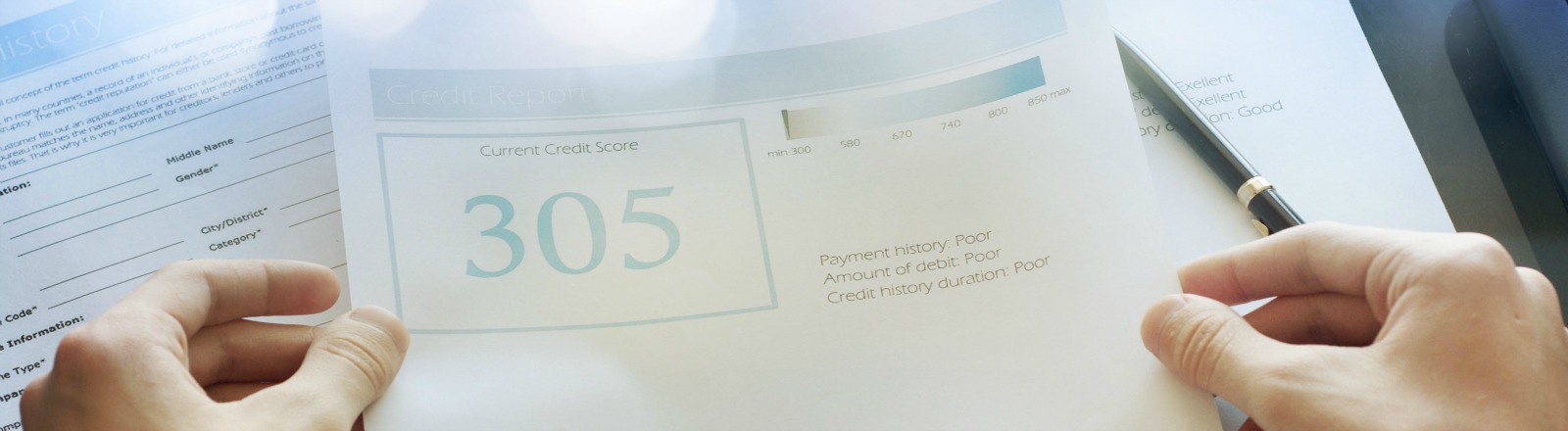

Most people are familiar with their credit score and understand the impact it has on their financial lives. Your personal credit score determines your ability to get approved for credit cards, loans and even housing.

But you may not realize that your business has its own credit score. Several business credit bureaus offer a variety of business scores, but they vary in how they’re calculated and what the numbers indicate about your company. In many ways, a business credit score serves the same purpose as a personal credit score. It tells lenders how likely your business is to repay a loan on time.

Plus, your business credit score can inform vendors and potential business partners about the health and stability of your operations. This can have a big impact on whether they will want to do business with you.

Dun & Bradstreet, Equifax, and Experian are the three major credit report services for small businesses. They’ll compile data about your business and determine your business credit score. How you manage these scores could influence whether you end up with bad credit business loans, or financing with more favorable terms. Let’s look at everything you need to know about how your business credit score is calculated.

Each of the three business credit bureaus runs a corporate credit report a bit differently, but they all weigh the same criteria. Business credit scores typically reflect public and legal records that show bankruptcies, liens or judgments against your company.

The scores also consider your company’s credit history, including payment habits, credit accounts, credit utilization and outstanding balances. Factors such as the size, industry and age of your business may be included as well.

Unlike Dun & Bradstreet, Equifax and Experian also offer consumer credit scores. That means your personal credit score can also influence your business credit score. But it doesn’t work the other way around.

Dun & Bradstreet offers proprietary scores and financial reports to businesses. Their basic corporate credit report, intended for lenders making credit decisions, includes a credit recommendation in addition to what they call a Paydex score.

This score — which ranges from 1-100, the higher the better — shows how your business prioritizes and pays its invoices. To be assigned a Paydex score, you must first have a D-U-N-S number, which you can establish for free at Dun & Bradstreet’s website.

A more advanced corporate credit report used to assess business risk also includes the D&B Viability Rating, which measures the health of your business. An even more comprehensive report is available to help verify a business’s financial stability. These reports are called financial stress scores and commercial credit scores.

A commercial credit score predicts the likelihood that your business will be delinquent on payment within the next 12 months. A financial stress score predicts how likely it is that your business will fail within the next year.

. These reports also typically compile your available financial statements, company profiles, and industry trends to help a lender or other business learn more about how your company’s finances stack up against others.

Keep in mind that you’ll need to have some existing vendor or credit accounts to be eligible for a score. For example, Dun & Bradstreet requires at least four payments on file before you can get a Paydex score.

The credit bureau Equifax evaluates your business in three different ways. There’s a payment index, a credit risk score, and a business failure score.

The payment index is measured on a scale of zero to 100. It evaluates how often your company pays its bills on time. This data is largely drawn from your creditors and vendors.

The business credit risk score helps creditors evaluate the likelihood that your business will make late payments. The business failure score predicts the chance that your business will fail in the next year.

Rather than offering a variety of scores and metrics like the other two major bureaus, Experian makes it simple. Each business gets one credit score, called the CreditScore report.

Experian’s business scores range from 0 to 100. The higher the score, the less risky your business will seem to lenders and vendors. Follow these tips from Experian on getting a credit score started in your company’s name!

Experian calculates your business credit score differently than the other two business credit bureaus. Instead of going solely off of payment history, Experian considers other factors like supplier information, state and local legal filings, lender information, and more.

NerdWallet provides clarity around decisions that help you start or grow your small business. We provide clear unbiased information, entrepreneur-focused advice, and tools for small-business loans, tax and legal issues. We also connect you with experts who can answer questions about growing your small business. Learn more