-

United Kingdom

- Sign in

Updated: 25 March 2021

While 2020 was a year like no other, it brought out the best in small businesses. They demonstrated just how resilient they are – adapting, pivoting and innovating their business through the challenges they faced, with the majority finding ways to continue trading. This has never been more vital for the UK economy, as they make up 99.7% of all businesses and have been responsible for 70% of all job creation since 2010.

To examine the role small businesses play in our economy, and to highlight how access to finance is crucial in helping them both survive and thrive, we partnered with Oxford Economics to examine the economic impact of UK small businesses.

Some of the key findings include:

To read the full report, you can find it here.

Alongside measures such as furlough, small business grants and tax breaks, the Government launched two flagship loan schemes to help businesses access additional finance: the Coronavirus Business Interruption Loan Scheme (CBILS) and the Bounce Back Loan Scheme (BBLS).

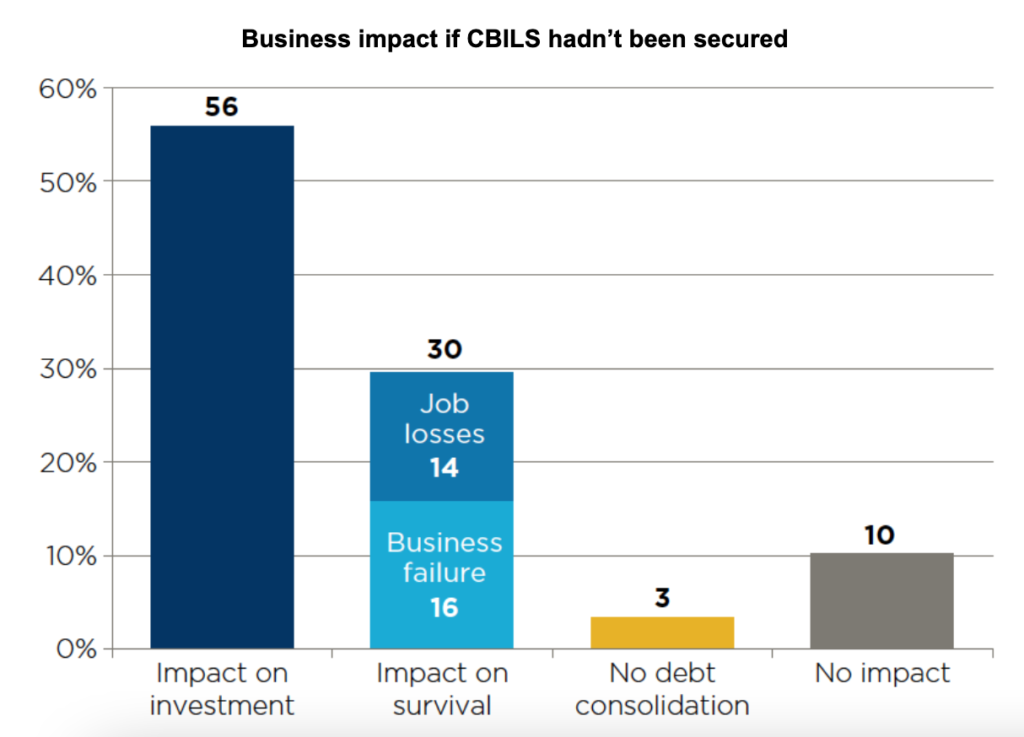

These schemes have been vitally important, with more than half of Funding Circle borrowers saying their investment plans would have been impacted without a CBILS loan. Additionally, despite a severe recession, these support measures have so far been effective in limiting the number of insolvencies among UK businesses, with the monthly average number of insolvencies since the first lockdown at its lowest level in the past decade.

We have always taken the approach that the best way to avoid unnecessary credit losses, which in turn protects investor returns, is to support the businesses you’ve lent to.

Providing access to CBILS and BBLS loans formed a key part of this. 43% of all our CBILS loans in 2020 went to existing borrowers, along with 100% of BBLS loans. Providing significant financial support to the businesses you’ve lent to has helped them weather the impact of the pandemic, avoid job cuts and build for the future.

As a result, the vast majority of businesses are making loan repayments, and projected returns remain positive overall. You can read more about this in our Chief Risk Officer’s UK update.

In 2020, small businesses continued to demonstrate their strategic importance to the UK economy.

The report looks at the three key ways in which lending through Funding Circle supports the UK economy:

When looking at this combined impact, in the UK in 2020 lending through Funding Circle supported:

In 2020, small businesses from every corner of the UK accessed finance through Funding Circle. Loans through the platform were issued to small businesses in 378 of the UK’s 379 local authority districts: from the far south-west of England, to the north of Scotland.

This lending reached communities which will benefit the most from it, with a higher proportion of lending going to small businesses located in areas experiencing social and economic challenges. In 2020, 14% of lending went to businesses located in the 10% of local authorities where residents earn the lowest wages, and 12% of lending to the 10% of local authorities with the highest unemployment rate.

As the UK continues along the path to economic recovery small businesses have ambitious growth aspirations, with 45% planning to grow either moderately or rapidly over the next 12 months.

In order to achieve this, the share of small businesses who are happy to use finance to grow is at the highest level it has been since 2016. Of the 73% of Funding Circle borrowers who expect to require future finance within the next year or beyond, more than eight out of ten would use this funding for investment and growth. This highlights the capacity, need and desire exists to invest and grow their business.

As we’ve seen, small businesses play a vital role in our economy, and providing access to finance continues to be crucial to helping them succeed. As the country begins to reopen, we stand ready to continue supporting small businesses, helping them to invest, grow, and drive the economic recovery.

All information from Supporting Businesses Through The Crisis And Recovery: Funding Circle’s 2020 Impact, Oxford Economics, March 2021

5779 REVIEWS