Business spending made simple

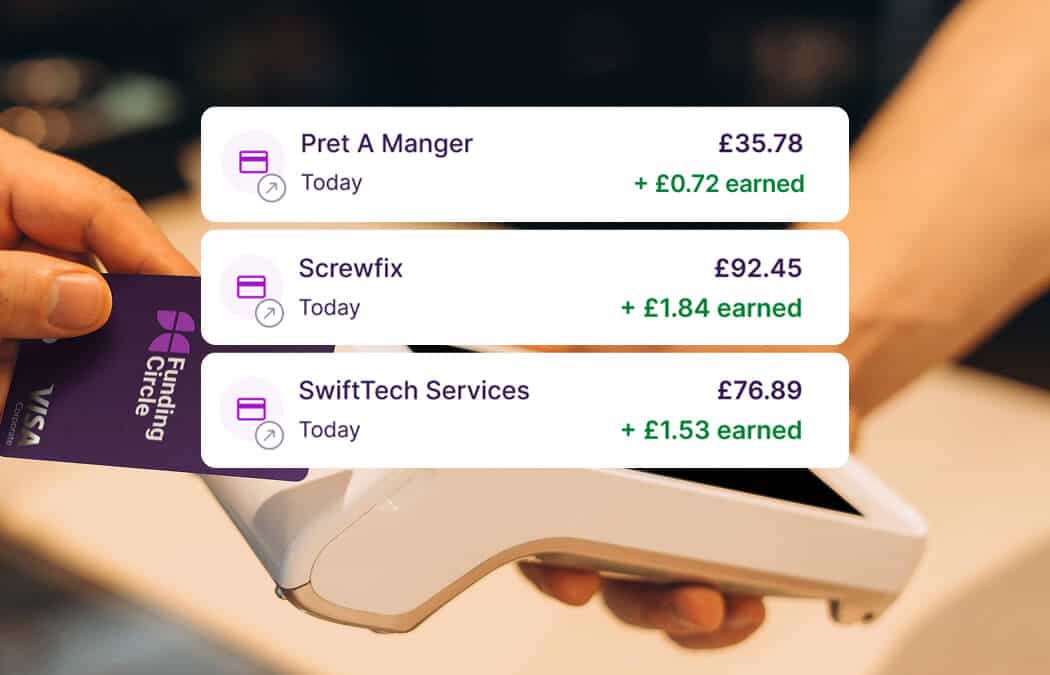

No more petty cash or chasing receipts. Give your trusted employees, partners, and contractors the freedom to buy what they need, anywhere Visa is accepted. It’s the simple way to manage expenses - with cashback on top.

Company cards that also let you claim control over your spend? We’ve got you covered. Our new Cashback Company cards turn employees’ everyday purchases into market-leading rewards. Ultimate value for your whole business.

Apply as a limited company without affecting your credit score

2% cashback for the first 6 months (up to £2,000)

1% uncapped cashback after that

Free unlimited Company cards

Up to £250,000 credit limit

Rates from 14.9% per year

No more petty cash or chasing receipts. Give your trusted employees, partners, and contractors the freedom to buy what they need, anywhere Visa is accepted. It’s the simple way to manage expenses - with cashback on top.

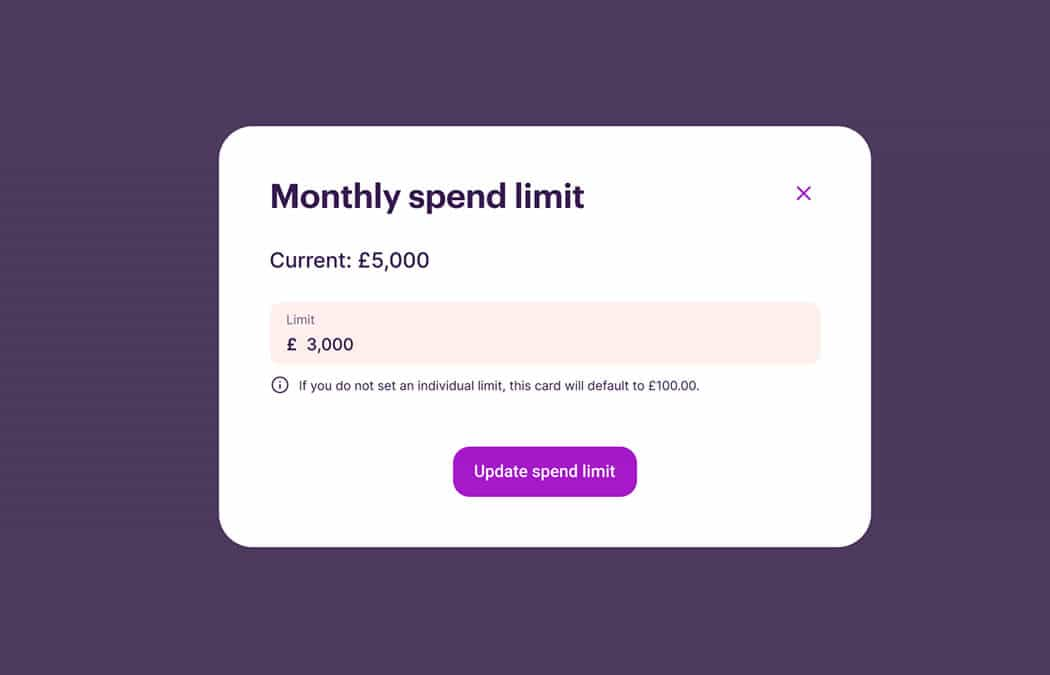

Get full visibility, all from your online account. You control the spending limits for each cardholder and can freeze or unfreeze cards in a click. That means it’s easier than ever to keep budgets on track.

We never charge a fee for adding more cardholders, giving you more leeway to scale up. Zero annual costs, unfair charges or foreign exchange fees.

Simply apply and receive a quick decision. No credit score impact. Your team will be up and running in no time at all.

As your trusted team puts back into your business, their transactions sync straight to one of Sage, Xero or FreeAgent. No manual expenses slowing them down.

Our secure integration is fully automated, so you can say goodbye to petty cash delays or time-consuming reimbursements. That’s because you’ll see your transactions in one convenient place. Giving you more time to run your business.

Think how much harder your team’s business spend could be working? Issue unlimited Company cards with absolutely no per-card fee. Then watch the cashback come in. Apply for your free cards now.

Company cards is our new ‘Beta’ feature that lets the main account holder easily issue multiple business credit cards to trusted team members and set their own custom spend limits.

Company cards are still in the ‘Beta’ stage, which means we’re still fine-tuning things to make them even better. We want customers to benefit from better spend control and market-leading cashback at the same time, while also collecting valuable feedback to make the product right for you.

Whilst we fine-tune the customer experience, the ‘Beta’ version lets you access benefits right away – like issuing multiple Company cards to earn more cashback, and controlling spend limits.

We’re working hard to fine-tune things for the full version, which will include:

Yes, Company cards still get 2% cashback for the first 6 months (up to £2,000), then 1% uncapped cashback after that. That means your whole team can earn cashback for your business.

Only the main account holder has the ability to issue new Company cards through their online account. This must be a director of the business.

There’s no cost to issue additional cards. Zero annual or subscription fees apply – and there are no extra costs for additional cards. Our goal is to provide a powerful cashback tool that helps you grow, without unfair monthly charges.

You can order an unlimited number of free cards for your team.

You can order cards for employees, other directors of the business, or business partners.

Go to the ‘Cards’ tab, then ‘Company cards’:

You can manage the monthly limit in your online account once the Company card has been ordered. This can range from £0 up to any amount. If you decide not to set a limit, the card will automatically default to £100 for security reasons.

Yes, simply go to your online account, then ‘Cards’, where you can choose to re-order or cancel a specific card.

*2% cashback for the first 6 months or up to £2,000, whichever comes first. Market-leading cashback business credit card where the business can apply without needing an existing current account with the credit provider.