Projected annualised return

To calculate it we take the following for the loans made each year:

Projected gross yield

The projected gross yield is an annualised estimate of the average interest rate, before fees and bad debt, paid on loans by the year they were made. The projected gross yield combines the actual gross yield received to date for each year, and the estimated gross yield for the remaining term of loans that have not yet been fully repaid. For each year of loans made, we take the average interest amount received per month, divided by the average outstanding loan balance per month.

The projected gross yield may change over time, such as when loans are repaid early, when businesses are unable to repay, or when new loans are made over the course of a year.

Projected bad debt rate

The annualised percentage of loans, by principal amount, that we estimate will not be able to be repaid. Loans are shown by the year they were made. The projected bad debt rate combines the actual bad debt rate for each year of loans to date, and the estimated bad debt rate for the remaining term of loans that have not yet been fully repaid. It also includes the recoveries we estimate to receive from loans that have been defaulted each year.

Funding Circle 1% servicing fee

The 1% servicing fee is deducted from monthly loan repayments when, and only when, they are received.

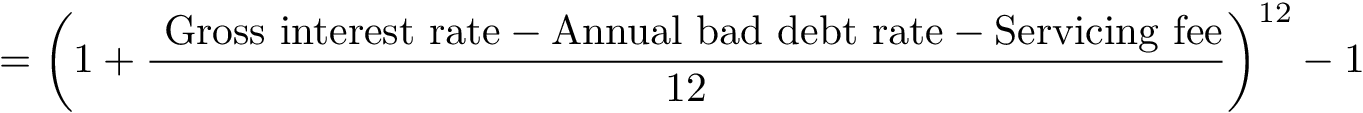

Formula

We then use the formula below to calculate the return. The formula takes a simple average of the estimated return after fees and bad debts, assuming re-investment of repayments at the same gross interest rate, for all loans accepted within the year.

Range of return

The return is shown as a range to reflect that the actual number of businesses who are unable to repay their loans could be higher or lower than estimated.

The projected annualised return is calculated by combining the actual annualised return received to date, and our latest return estimates for the remaining term of loans that have not yet been fully repaid. To provide the range, we take our latest return estimates for the remaining terms of the loans that have not been fully repaid, then adjust these estimates based on the following assumptions:

- High end of the range - A lower actual default rate, and a higher recovery rate than projected

- Low end of the range - A higher actual default rate, and a lower recovery rate than projected

Please remember

This return is the projected annual return after fees and bad debts for loans made in a particular year. As with many calculations there are some important points to keep in mind, including:

- Past returns are not necessarily a guide to future returns and by lending to businesses your capital is at risk

- The calculation is partially based off estimated bad debt rates and actual bad debt rates may differ

- Estimated bad debt rates are based on our current expectations and may be adjusted if our expectations change, for example if macroeconomic conditions change

- It is before tax: different investors have different tax rates and some earnings are taxed differently. Read more.

- It does not include any amounts not lent to businesses

- It compounds interest after fees and bad debt, and therefore assumes re-investment