Calculating the average return

The return is a percentage, calculated to show the return investors* have earned through Funding Circle after fees and bad debt, but before tax, over an annualised period.

To calculate it we take the following:

- Daily cashflows (C):

-

These are the cashflows in and out of each investor's account, including:

- Any amounts lent to businesses – this amount is registered from the day your order is placed.

- Any amounts received – in repayments (which include interest and principal), any proceeds from secondary market sales and any promotional earnings. These are net of fees.

- Any deposits into your account which are not yet lent to businesses

- Any withdrawals

- Principal outstanding at the end of the period (P):

- Accrued interest throughout the period (I):

We take the sum of the cashflows for every day the investor has been lending (ie, from day 1 right through to the current day).

This will reflect the outstanding amount lent to businesses, less any bad debts you have incurred during the period

This is the amount of interest you have earned up until the current day but has not yet been paid to you

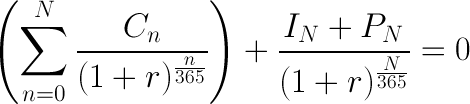

The above inputs are taken over a given time period so we can calculate the return for each investor, whereby:

- N = the total number of days since you started lending

We create an annualised return figure ( r ) by calculating this over a 365 day period.

We then use this formula to calculate the return:

Limitations to this calculation

This return expression is just one way to show the returns investors have made through Funding Circle. We think it is the most useful and accurate way to measure investment performance because it takes into account both our fees and any bad debts but as with many calculations it has some limitations, including:

- It is before tax: as different investors have different tax rates and some earnings are taxed differently. Read more.

- It does not include any amounts not lent to businesses

- It does not include the end-to-end cycle of loan repayments

- Past returns are not necessarily a guide to future returns

There are other methods for evaluating historical or potential investment return that you could choose to use instead and you may want to consider these methods as well.